Finding the right car for you is special. We are here to turn your dream into a reality. Our team of experts have a wealth of knowledge in finding the best finance for you. Centrepoint Finance goes the extra mile for the best rates and solutions tailored to you.

Whether you’re looking to buy a new car or a used car, Centrepoint will meet your vehicle financing goals. We aim to make your journey to your dream vehicle simple and rewarding.

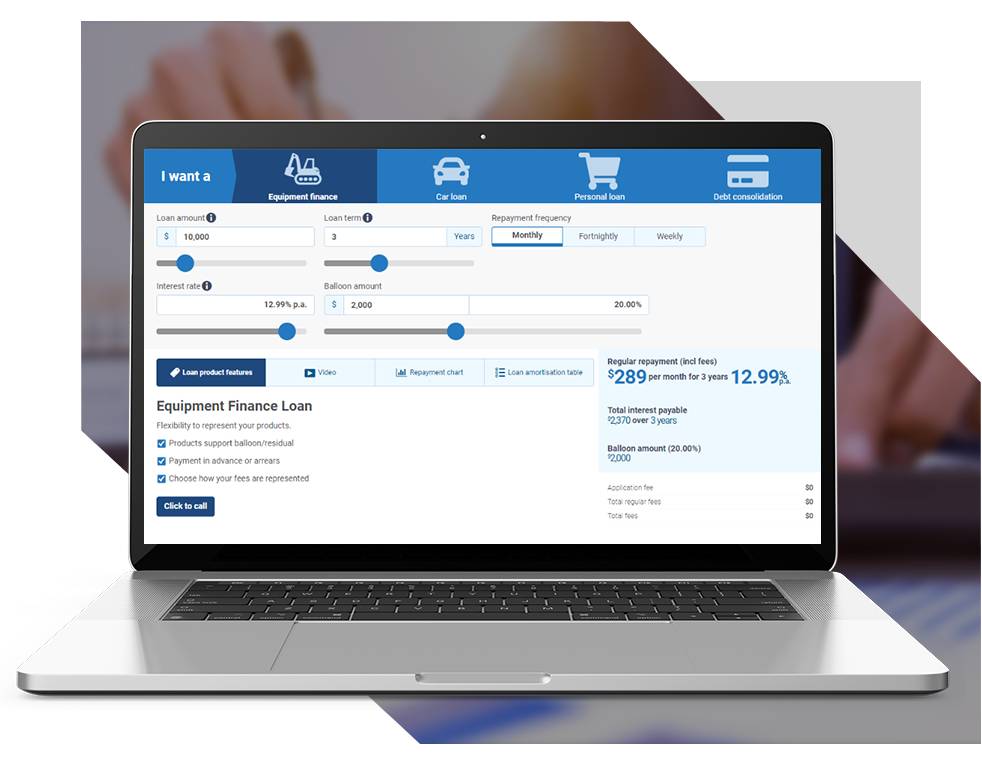

From a truck to a delivery vehicle or an electric car, Centrepoint Finance solutions will work alongside your cash flow and reduce your risk by offering repayment frequency options. Our team has expertise in all industries needing commercial car finance. If you need to finance a company vehicle, we’ll make sure to keep those wheels turning.

If you need commercial vehicle finance, we have a range of specialised services to help you find the right loan. Whether you are looking at commercial vehicle leasing or commercial car financing, our experts will give you the right advice.