Get Your Personalised

Commercial Fit Out

Finance Options Today

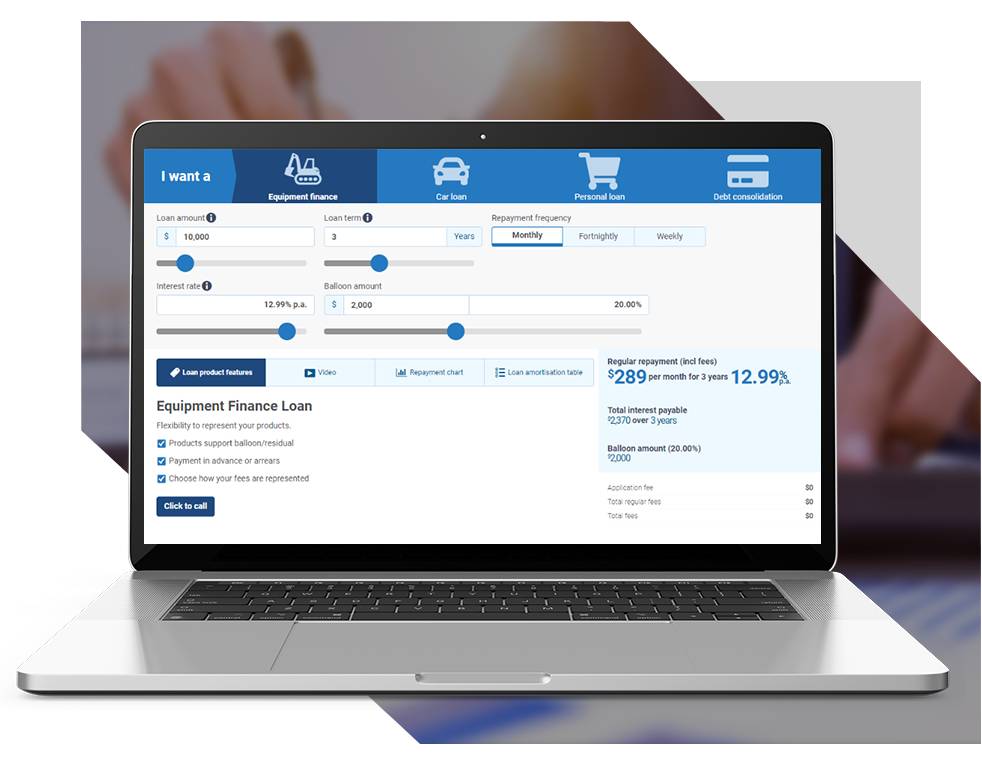

Fitout Finance

Fit-out finance in Australia is a type of financing solution designed for businesses looking to fund their commercial fit-out projects. We offer a flexible and cost-effective way to secure funding and complete fit-out projects efficiently.

GET PRE-APPROVED NOW