Competitive

Secure the best vendor finance options with our competitive rates and expert team. Our access to industry-low rates ensures you get the best financing solution for your business.

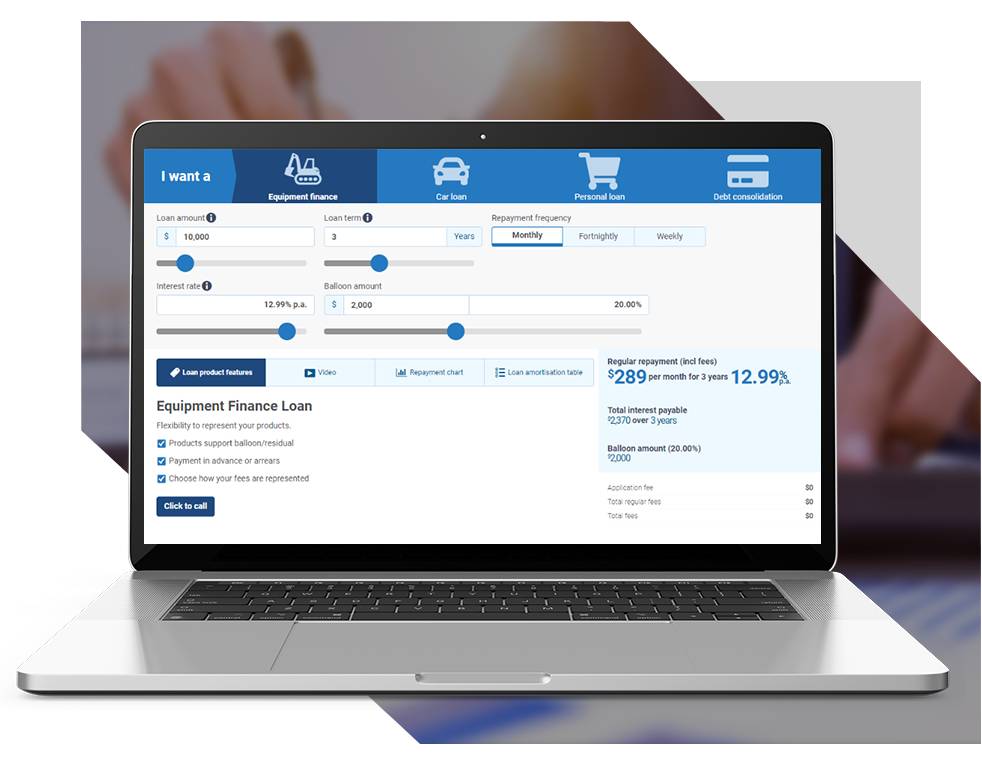

No paperwork

Easily apply for vendor financing online with our quick and convenient process. Enjoy fast approvals and manage your account from the comfort of your own home.

Fast Approvals

Vendor finance online applications are convenient, fast, and provide access to financing options, helping businesses to preserve cash flow and grow.

Tailored

Customized vendor finance plans align with your business needs, offering payment flexibility and protecting cash flow for potential expansion.